Maybe is an open source personal finance management tool that helps you track and manage your assets, liabilities, transactions, and budgets. Maybe provides a set of tools and features to help you monitor your financial health, track your spending, and make informed decisions to optimize your financial well-being. Maybe is designed to help you manage your finances effectively, track your assets and liabilities, and achieve your financial goals.

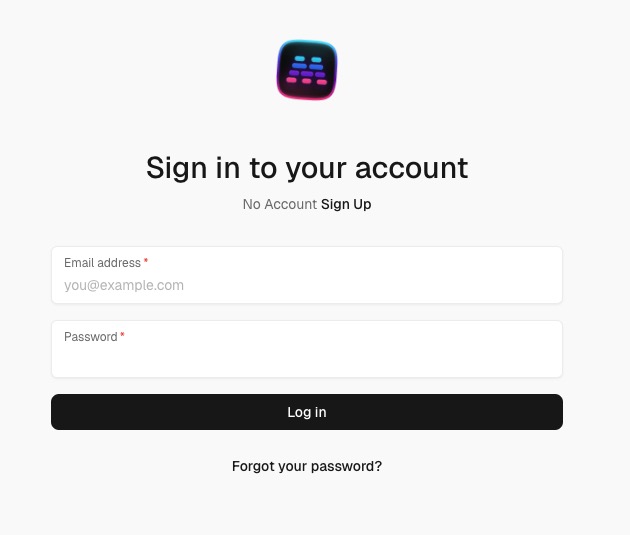

Login

On your first visit to the site, you will be presented with the login/signup screen.

When your instance is first created, an account is created for you with the email you chose. You can get the password for this account by going to your Elestio dashboard and clicking on the "Show Password" button.

Enter your username and password and click the "Log in" button.

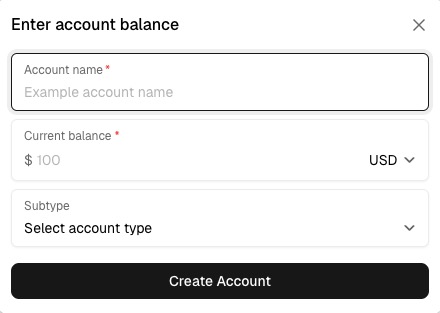

Account Balance

Account Balance in Maybe is the amount of money you have in your account. It helps in managing your assets by providing information about the money you have. You can view the account balance to get insights into the amount of money you have, the transactions you have made, etc. Account Balance is essential for tracking and managing your assets, allowing you to monitor your financial status and make informed decisions. By using Account Balance, you can identify trends, optimize your spending, and improve your financial health. Account Balance provides a summary of your financial status, helping you stay informed and achieve your financial goals effectively.

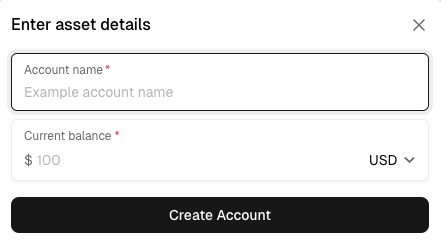

Creating Asset

Assets in Maybe are the items that you own. Assets help in managing your belongings by providing information about the items that you own. You can view the assets and get insights into the value of the items, the condition of the items, etc. Assets are essential for tracking and managing your belongings. Assets provide a way to store your items and keep track of their value. By using assets, you can organize your belongings effectively and access them easily when needed. Assets are essential for tracking and managing your belongings, allowing you to prioritize and manage them efficiently.

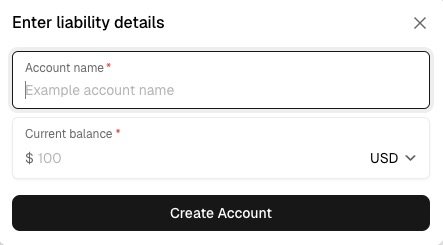

Adding Liability

Liability in Maybe is the amount of money you owe to others. It helps in managing your debts by providing information about the money you owe. You can view the liability to get insights into the amount of money you owe, the creditors you owe money to, etc. Liability is essential for tracking and managing your debts, allowing you to monitor your financial obligations and make informed decisions. By using Liability, you can identify trends, optimize your debt repayment, and improve your financial health. Liability provides a summary of your financial obligations, helping you stay informed and achieve your financial goals effectively.

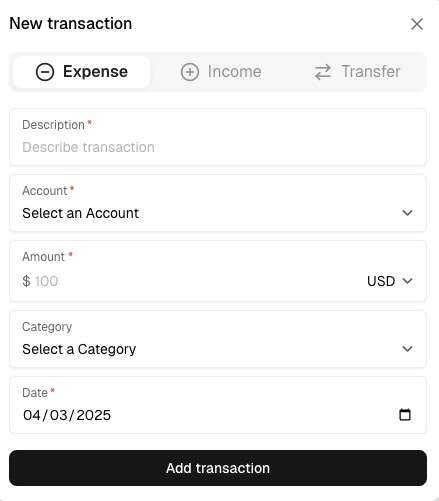

New Transaction

Transaction in Maybe is the record of financial activities within your account. It provides a detailed history of transactions such as deposits, withdrawals, and other important occurrences. By reviewing transactions, you can gain insights into your financial status, spending habits, and key metrics. This information helps in identifying patterns or issues, optimizing your spending, improving your financial health, and making informed decisions to drive growth and success. Transactions are essential for maintaining the health and performance of your account, allowing you to track your financial activities effectively and ensure smooth operation.

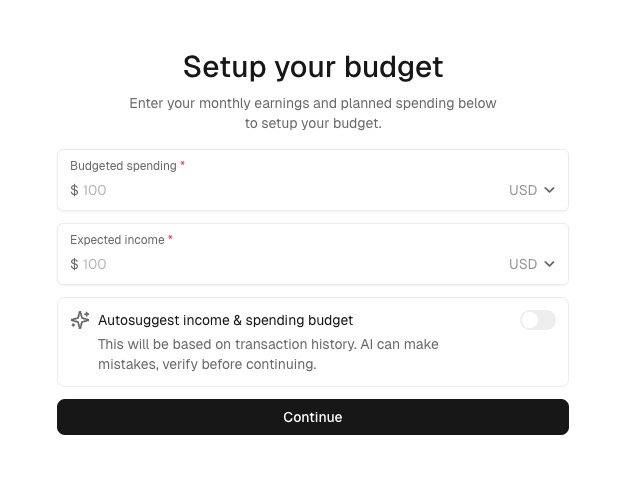

Setup your budget

Budget in Maybe is the plan for your spending and saving. It helps in managing your finances by providing information about your financial goals. You can view the budget to get insights into your spending limits, saving goals, etc. Budget is essential for tracking and managing your finances, allowing you to monitor your financial health and make informed decisions. By using Budget, you can identify trends, optimize your spending, and improve your financial well-being. Budget provides a summary of your financial goals, helping you stay informed and achieve your financial objectives effectively.